Today, across the country, the central government requires people to pay tax every year to give them a record of their income. The last date for paying tax has also passed.

A news has come out for the people who file ITR. It is being told that the customers who file ITR are given a refund in tax. The benefit of refund is available only to those people whose ITR is filed on time.

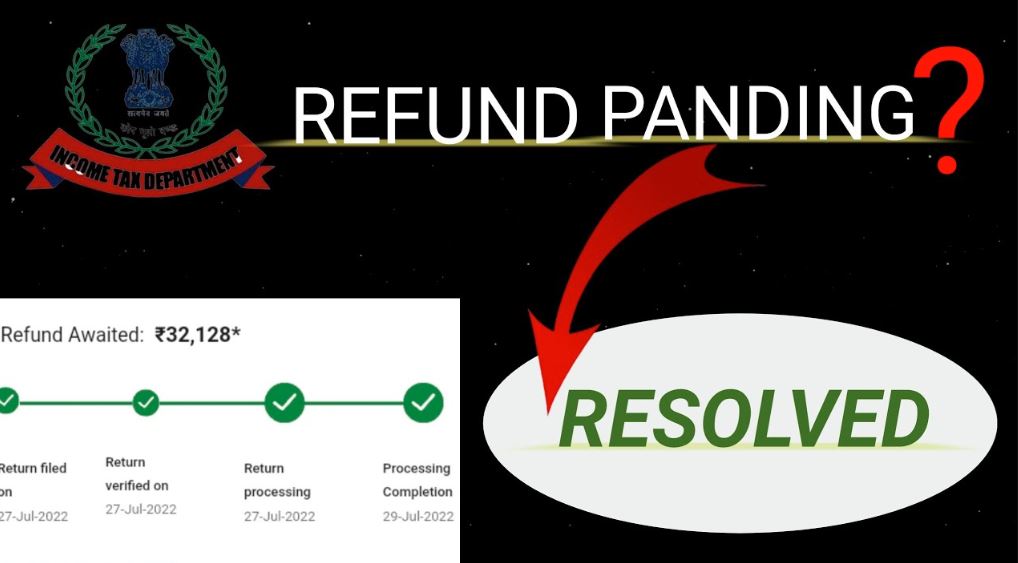

Today, people who want to get ITR refund are waiting for a long time. This time a lot of increase has been seen in the e-filing of ITR. People get the benefit of refund on their income tax. It is being told that the taxpayer is given the benefit of refund 30 days after filing the refund ITR.

Income Tax Department issued new rules-

Every year taxpayers have to file ITR on their income. After filing ITR on time, the taxpayer is given a refund within a month. If you are also waiting for your refund, the Income Tax Department has implemented new rules for taxpayers seeking refund.

These taxpayers get refund-

Every year millions of people pay tax in the country. Not all these taxpayers are given the benefit of refund. These taxpayers get a claim for refund who have paid more tax than the prescribed tax while paying their tax last year. The Income Tax Department gives the benefit of refund to these customers.

The department will reimburse the outstanding tax-

The Income Tax Department is empowered by the government to compensate any taxpayer for his past due tax from his refund. Through this process, the department informs the customers who file an ITR.

This is how you will get a refund-

Taxpayers filing ITR will have to go to their portal and get themselves registered.

After login, you will have to go to Income Tax Return by going to the e-File option.

You can check your refund by going to View Filed Returns.